Mastering the Forex Market: Strategies, Tips, and Tools

The foreign exchange (Forex) market is the largest and most liquid financial market in the world, with trillions of dollars exchanged daily. Understanding how to navigate this complex environment is essential for anyone looking to succeed in trading. Whether you’re a beginner or an experienced trader, leveraging resources such as forex market trading MT4 Forex Brokers can significantly enhance your trading experience.

Understanding Forex Trading

Forex trading involves the exchange of one currency for another at an agreed price. It operates 24 hours a day, five days a week, and is decentralized, meaning transactions occur over-the-counter (OTC) rather than through a centralized exchange. The currency pairs are categorized into three main types: major pairs, minor pairs, and exotic pairs. Major pairs include the most traded currencies, such as EUR/USD and USD/JPY, while minor pairs consist of currencies that are less frequently traded.

Key Components of Successful Forex Trading

To achieve success in Forex trading, one must master several essential components:

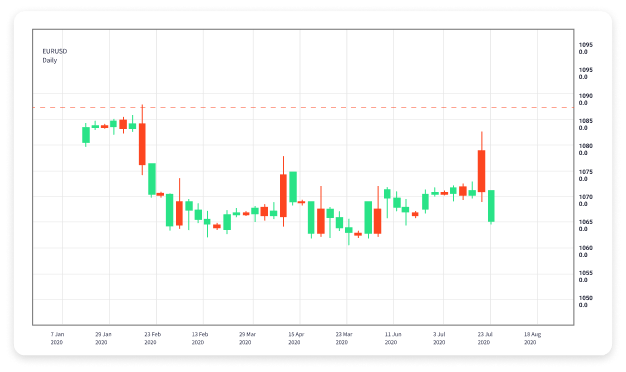

- Market Analysis: There are two primary forms of analysis: fundamental and technical. Fundamental analysis focuses on economic indicators, central bank policies, and geopolitical events that can affect currency values. Technical analysis, on the other hand, involves studying past market data, price patterns, and charts to predict future movements.

- Risk Management: Effective risk management protects your capital. This includes setting stop-loss orders, determining the appropriate position size, and diversifying your trades to spread risk.

- Trading Strategies: Developing a trading strategy based on your market analysis helps you make informed decisions. Popular strategies include day trading, swing trading, and scalping.

- Emotional Discipline: Emotional control plays a vital role in trading. Fear and greed can lead to impulsive decisions. Maintaining discipline and sticking to your trading plan is crucial for long-term success.

Types of Forex Orders

Understanding different types of orders is fundamental to mastering Forex trading. Some common order types include:

- Market Order: Executes a trade at the current market price.

- Limit Order: Sets a specific price at which to buy or sell a currency pair.

- Stop-Loss Order: Automatically closes a trade when it reaches a certain loss level to mitigate risk.

- Take-Profit Order: Closes a trade once it reaches a predetermined profit level.

The Role of Leverage in Forex Trading

Leverage allows traders to control larger positions with a smaller amount of capital, amplifying potential profits. However, it also increases the risk of significant losses. Understanding how to use leverage effectively is crucial for any Forex trader. Brokers typically offer different levels of leverage, and it’s important to choose a level that aligns with your risk tolerance and trading strategy.

Choosing a Forex Broker

Finding the right Forex broker is essential for your trading success. Here are some factors to consider:

- Regulation: Ensure your broker is regulated by a recognized authority to protect your funds.

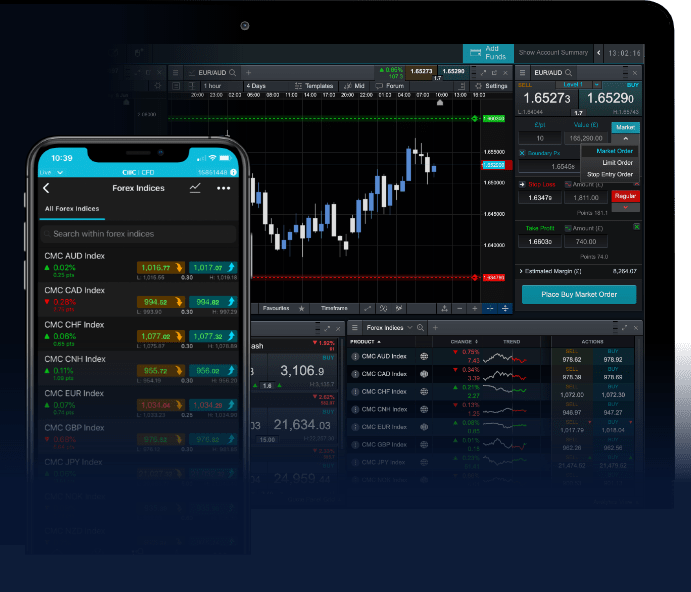

- Trading Platform: Familiarize yourself with the broker’s trading platform. Popular options include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Spreads and Commissions: Compare the costs associated with trading, such as spreads, commissions, and overnight fees, to find the most cost-effective option.

- Customer Support: Reliable customer support is crucial, especially for addressing issues real-time. Look for brokers that offer multiple support channels.

Staying Informed: Economic Calendars and News Feeds

Staying updated on economic events is vital for Forex traders. Economic calendars provide insights into upcoming data releases, central bank meetings, and other significant events that can impact the market. Incorporating news feeds into your trading routine helps you stay informed about market sentiment and potential price movements.

Continuous Learning: Resources for Forex Traders

The Forex market is constantly evolving, and continuous learning is key to staying competitive. Here are some resources to consider:

- Books and E-books: Explore literature on trading strategies, risk management, and market psychology.

- Online Courses: Enroll in courses offered by established trading educators to gain structured knowledge.

- Webinars and Workshops: Participate in live sessions hosted by experienced traders to gain real-time insights and practical tips.

Conclusion

Forex market trading presents both opportunities and challenges. By mastering market analysis, leveraging risk management strategies, and continuously educating yourself, you can enhance your trading skills and improve your chances of success. Remember, patience and discipline are as important as knowledge in the world of Forex trading. Start small, learn continuously, and over time, you may find yourself navigating the Forex markets with confidence and competence.