Forex Trading Framework: Professional Guidelines for Success

In the dynamic world of forex trading framework professional guidelines forex-level.com, having a solid framework and adhering to professional guidelines is vital for achieving success. The forex market is known for its high volatility and rapid market movements, which can be both an opportunity and a risk for traders. This article delves into essential guidelines and frameworks that can enhance your trading strategies, manage risks effectively, and optimize your trading performance.

Understanding the Forex Market

The foreign exchange market, known as forex or FX, is the largest financial market in the world, facilitating the exchange of currencies. With an average daily trading volume exceeding $6 trillion, understanding the intricacies of this market is fundamental for any trader. The forex market operates 24 hours a day, five days a week, providing ample opportunities for those willing to learn and adapt.

The Importance of a Trading Framework

A trading framework provides structure to your trading activities and helps you stay disciplined. It consists of various components, including risk management, trading strategies, psychological resilience, and continuous learning.

1. Risk Management

Effective risk management is arguably the cornerstone of successful forex trading. It involves implementing measures to minimize potential losses. Traders should start by determining their risk tolerance and setting stop-loss orders to limit losses on each trade. A common guideline is to risk no more than 1-2% of your trading capital on any single trade.

2. Trading Strategies

Developing a robust trading strategy is essential. Traders can choose from various strategies, such as day trading, swing trading, scalping, or long-term investing. Each strategy has its own set of rules and timeframes for entering and exiting positions. A good practice is to backtest your strategy using historical data to ensure its viability before applying it in the live market.

3. Trade Psychology

Psychological resilience is a critical component of trading success. The emotional rollercoaster of trading can lead to impulsive decisions. Maintaining a calm and disciplined approach is crucial. Techniques such as mindfulness and maintaining a trading journal can help traders reflect on their decisions and emotions.

4. Continuous Learning

The forex market is constantly evolving, meaning new information and technologies emerge frequently. Staying informed about market trends, economic indicators, and geopolitical factors that can impact currency prices is imperative. Traders should invest time in continuous education, whether through courses, webinars, or experienced mentors.

Key Elements of a Forex Trading Framework

To build a successful forex trading framework, consider incorporating the following key elements:

1. Define Your Trading Goals

Start by setting clear and attainable trading goals. Whether your aim is to generate consistent income, build wealth, or simply learn the ropes, having specific objectives helps to guide your trading decisions.

2. Choose a Reliable Broker

Your choice of forex broker plays a significant role in your trading journey. Look for a broker that is regulated, offers competitive spreads, provides an intuitive trading platform, and has a solid reputation for customer service.

3. Create a Trading Plan

A well-structured trading plan outlines your trading strategy, risk management techniques, and trading objectives. This roadmap serves as a reference point, helping to maintain discipline and focus.

4. Analyze the Market

Market analysis can be divided into three categories: fundamental, technical, and sentimental analysis. Fundamental analysis focuses on economic indicators, while technical analysis involves studying price charts to identify patterns and trends. Sentiment analysis considers the emotional climate of the market, which can influence trading behavior.

5. Execute and Review Trades

Once your analysis is complete, execute your trades based on your trading plan. Afterward, review your trades to learn from your successes and mistakes. Regularly reflecting on your trading performance is crucial for improvement.

Tools and Resources for Forex Traders

Utilizing the right tools and resources can enhance your trading efficiency. Some essential tools include:

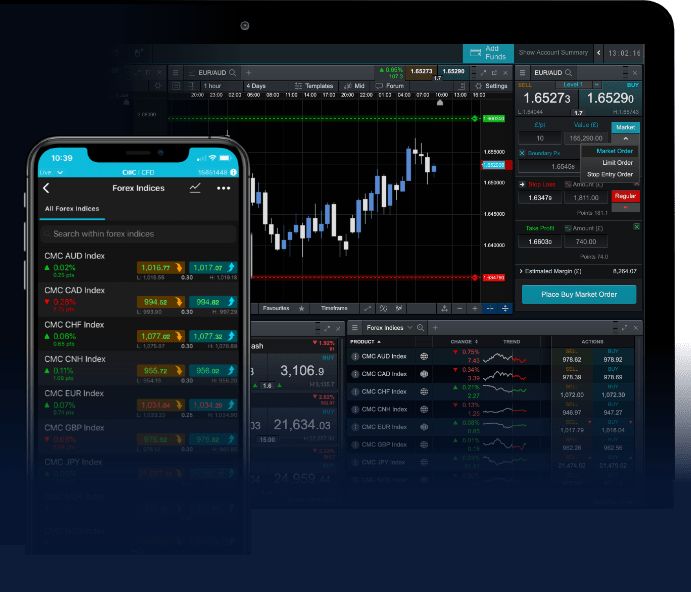

1. Trading Platforms

Choosing the right trading platform is crucial. Look for a platform that offers advanced charting tools, indicators, and a user-friendly interface.

2. Economic Calendars

Economic calendars track important economic events and releases that can influence currency prices. Staying updated on these events helps traders anticipate market movements.

3. Trading Journals

Maintaining a trading journal allows you to document your trades, including your rationale for entering and exiting trades, as well as your emotional state during trading sessions. This reflective practice can lead to valuable insights and improvements in your trading approach.

4. Market Analysis Reports

Many brokers and financial institutions offer market reports and analysis, providing insights into market trends and predictions. These reports can serve as useful resources when making trading decisions.

Conclusion

In conclusion, establishing a comprehensive forex trading framework alongside strict professional guidelines greatly enhances your chances of success in the forex market. By focusing on risk management, developing sound trading strategies, maintaining psychological resilience, and embracing continuous learning, traders can navigate the complexities of the forex landscape with greater confidence and proficiency. Remember, trading is a journey that requires patience, discipline, and a commitment to self-improvement.